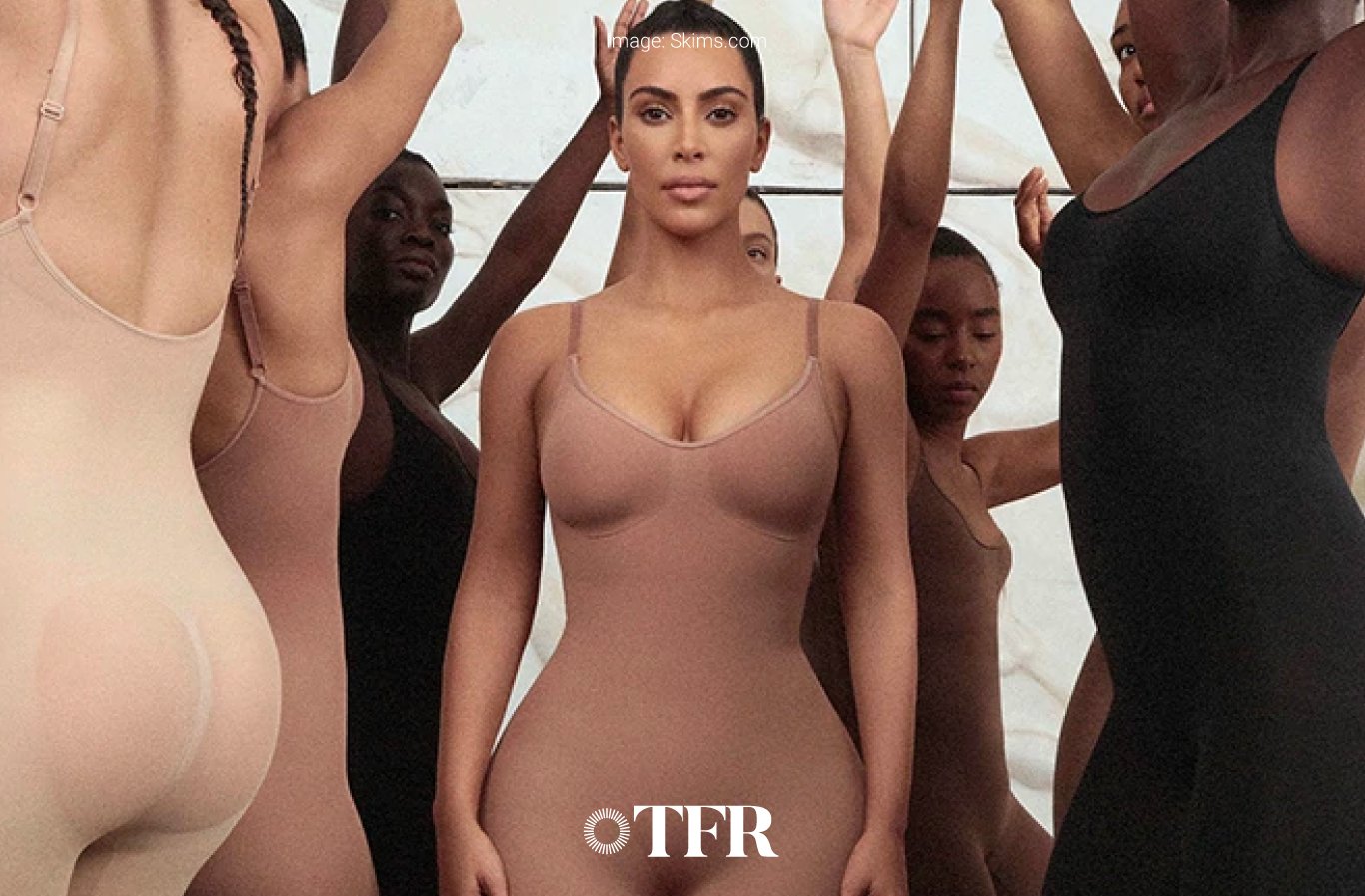

Kim Kardashian’s shapewear label Skims doubles valuation to $3.2 billion after raising $240 million in latest funding round

Kim Kardashian’s shapewear label Skims announced that it had doubled its valuation to $3.2 billion after the brand raised $240 million in its latest funding round.

According to Skims CEO Jens Grede, the funding round was led by hedge fund Lone Pine Capital and joined by investment firm D1 Capital Partners. Existing investors Imaginary Ventures, Alliance Consumer Growth and Thrive Capital also participated in the round.

Kardashian and her business partner Grede will still retain a controlling stake in Skims following the deal. According to BOF, the pair does not plan to sell the business or to file for an initial public offering, though that may be considered at some point, Grede said.

“This latest round will allow us to focus on bringing more innovations and solutions to our customers and become even more of a trusted resource for them,” Kardashian said in an email.

Skims was founded in 2019. Initially, the label offered original shapewear from bodysuits and boy shorts to loungewear like pyjamas and sweatpants. Recently, it expanded its product line by releasing a wide range of basics that include pullovers, sleep robes and turtlenecks.

Last year, the brand managed to boost its sales by 90% to about $275 million. Back in April 2021, Skims was valued at $1.6 billion. The recent deal will be used by the management to bolster the balance sheet and pump money into expansion plans.

“We see an opportunity with Skims to create our own category in retail, just like how we believe Lululemon and Starbucks created their own categories in their respective areas,” said Grede. “That’s really why we’re doing this, to make sure we’re best prepared for the future.”